Return and principal worth of investments will fluctuate and, when redeemed, could also be worth roughly than their unique price. There is no assure that past efficiency or data referring to return, volatility, type reliability and other attributes might be predictive of future outcomes. They are used for illustrative functions only and do not symbolize the efficiency of any particular investment. The worth of investments will fluctuate, which is in a position to trigger costs to fall in addition to rise and you could not get again the original quantity you invested. The views expressed here should not be taken as a suggestion, advice or forecast.

Schedule A Name With A Wealth Manager To Get Started

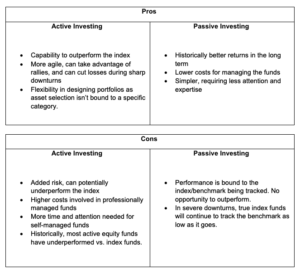

Please make positive you perceive how this product works and whether you’ll have the ability to afford to take the high danger of shedding money. This is a marketing communication and on no account must be viewed as funding analysis, recommendation, or a advice to invest. The worth of your funding can go up as well as down, and you may lose part or all your invested capital. Previous efficiency of monetary instruments does not assure future returns. Investing in monetary devices entails threat; before investing, contemplate your information, expertise, financial state of affairs, and funding goals. Before deciding which investment technique is right for you, contemplate the potential advantages and disadvantages of energetic investing.

Is Passive Investing Much Less Risky Than Energetic Investing?

Historically, that may imply incomes a median annual return of nearly 10% when you invested in the U.S. stock market. However, a passive strategy will typically serve you higher if you’re investing for the long haul. It is in all probability not flashy or thrilling, however it’s a method you’ll be able to take to the bank…literally. Fairness securities might fluctuate in response to information on companies, industries, market circumstances and general financial environment. Whether you prefer to independently handle your retirement planning or work with an advisor to create a personalized strategy, we can help. Roll over your 401(k) out of your earlier employer and examine the advantages of Common Investment, Traditional IRA and Roth IRA accounts to decide which is right for you.

Nonetheless, your technique is decided by your state of affairs and would not essentially look the identical as that of all different passive traders. In contrast to passive investing, lively investing includes making investment selections primarily based on the investor’s or fund manager’s convictions, rather than following the index. Active managers in the eurozone large-cap mix category gained floor, with 23.5% beating their passive counterparts in the one-year period to June 2025. In the identical category, long-term success charges for energetic managers remain low, with the common 10-year success rate being around four.7%. Our analysis exhibits that European lively managers are most likely to fare better in the mid-cap and small-cap fairness classes compared to large-cap stocks.

«In reality, any edge they might create is often eliminated by the additional fees they charge, the buying and selling costs they incur, and the higher taxes they create.» In the US, actively managed mutual funds and ETFs struggled mightily from July 2024 via June 2025. Simply 33% of active methods survived and beat their asset-weighted common passive counterparts, a drop of 14 percentage factors from a 12 months earlier. As A Result Of of the research active investing requires, including trading costs and taxes generated from frequent buying and selling, lively investing sometimes has greater complete prices than passive investing, lowering web returns.

IG accepts no duty for any use that might be made of these comments and for any penalties that result. No representation or warranty is given as to the accuracy or completeness of this information. Any analysis provided doesn’t have regard to the specific funding aims, financial state of affairs and desires https://www.xcritical.com/ of any particular one that could obtain it. It has not been prepared in accordance with authorized necessities designed to advertise the independence of funding research and as such is taken into account to be a advertising communication.

Plan Your Buying And Selling

In some regions, they proceed to be the dominant strategy in belongings beneath administration. Just 21% of them survived and beat their average listed peer over the final decade pros and cons of active investing by way of June 2025. According to figures from the Funding Association (IA), whole property under administration within the UK reached £9.4 trillion in 2020, for example. At this time, passive strategies accounted for 31% of the £9.four trillion, a one share point improve since the earlier 12 months. At Plancorp, we develop your financial plan collectively and make informed funding and asset allocation choices that align with your monetary goals, danger tolerance and investment timeline. On the flip side, investing in a diversified portfolio minimizes the “specific” danger you tackle.

- Insurance products are made obtainable through Chase Insurance Company, Inc. (CIA), a licensed insurance coverage company, doing business as Chase Insurance Coverage Agency Providers, Inc. in Florida.

- In our view, each active and passive strategies can play a role in a well-balanced portfolio.

- However if you had invested for the long run during that time, you can anticipate to earn a mean return of 10% per year.

Actual occasions Cryptocurrency wallet could differ from those assumed and adjustments to any assumptions could have a material influence on any projections or estimates. Other occasions not taken under consideration may occur and should considerably have an effect on the projections or estimates. Accordingly, there may be no assurance that estimated returns or projections will be realized or that precise returns or performance results won’t materially differ from those estimated herein. Passive investing doesn’t suggest that you do not care about your investments — being passive is only a technique that basically says markets are environment friendly, and over the lengthy term, it is hard to beat the typical web of fees.

They would possibly interact in active trading vs. long-term investing, hypothesis, or depend on skilled fund managers via energetic vs. passive fund administration. However the key perception for a lot of buyers is that you don’t want to decide on between index approaches and lively strategies—it doesn’t need to be all one or the other. By mixing actively managed funds with passive index approaches, you possibly can customise your portfolio to meet your funding objectives. Yes, you presumably can mix passive and energetic investing strategies, similar to by owning some passive funds and a few active funds. You might achieve this by selecting passive for some kinds of belongings like shares whereas active for property like bonds. Also, quite than only using the buy-and-hold philosophy to grow wealth in the lengthy run, energetic investors can implement different buying and selling methods like shorting inventory or hedging.

Instead of trying to beat the market, passive investors seek to match market performance by investing in index funds or exchange-traded funds (ETFs). Or is energetic investing outlined more by sector bets like QQQ, which tracks the Nasdaq-100? Even market-cap weighting, the cornerstone of passive, is a alternative, albeit a extensively accepted one. Over long durations, such as 5 or 10+ years, passive investors tend to outperform active investors. Much is determined by the particular methods though, and the future could be unpredictable.